KASE Day in Astana - about development of the exchange ecosystem, capital market growth, new products and services

On February 10, KASE Day in Astana took place - a traditional platform for open dialogue on current trends of the stock market, results of development of the exchange ecosystem and the priorities of the KASE Group.

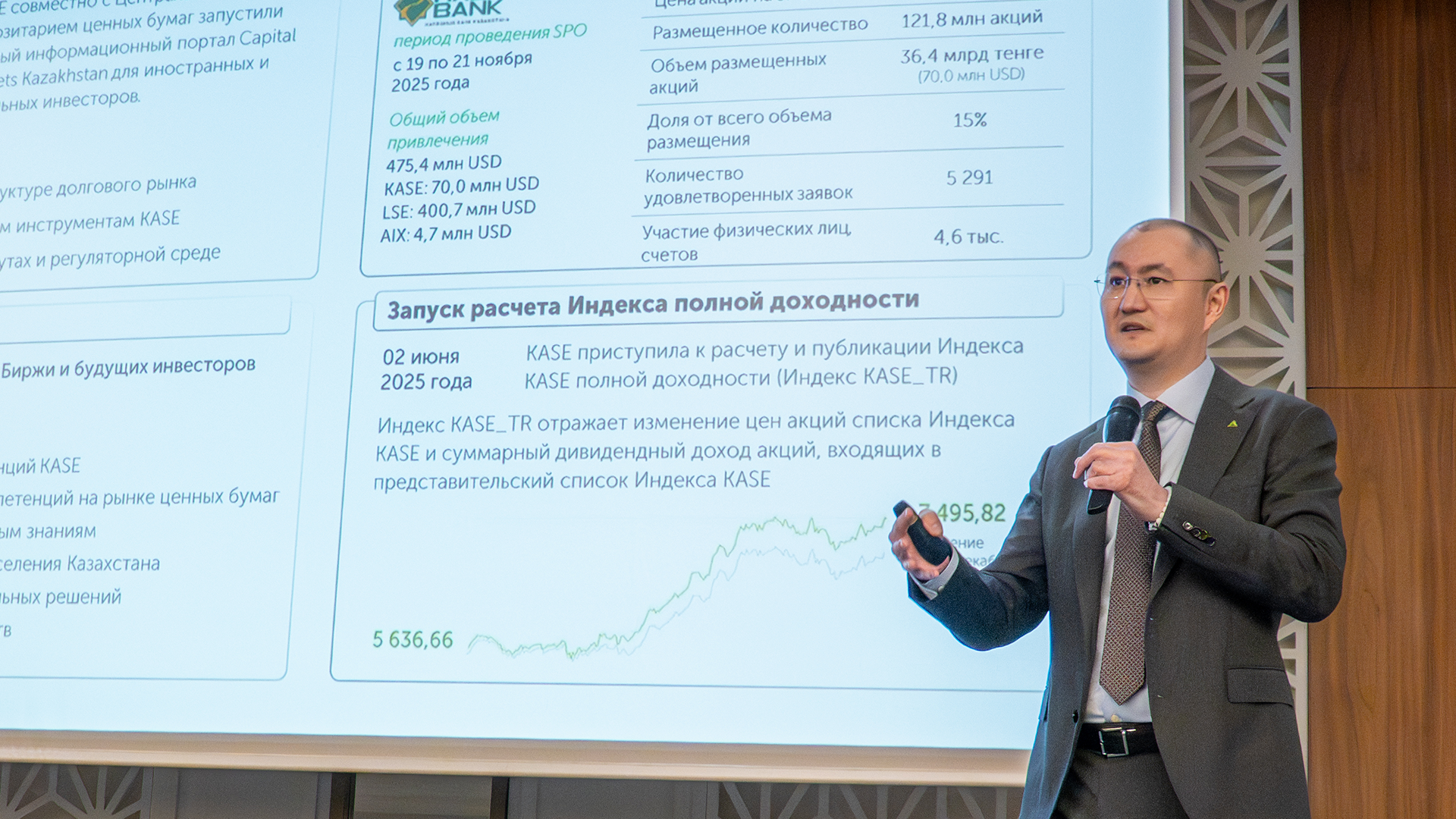

Kazakhstan's capital market demonstrated stable growth and expanded opportunities for participants in 2025. KASE continues to strengthen its role as a key infrastructure platform uniting trade, products and services for development of the local market. Chairperson of KASE's Management Board Adil Mukhamejanov reported this while summing up the results of the year.

The trading volume on KASE reached 400 trln tenge, increasing by 3% year-on-year. The number of transactions on the securities market increased by 74%, and the KASE Index gained 26%, reflecting increased investor interest and the market strengthening.

As part of its new Strategy, the Exchange focuses on strengthening its leadership positions and expanding its product line. These priorities are already being put into practice. Among the key initiatives is the SME Qadam Bonds program that became an effective entry point for SMEs into the capital market.

An important step was also the launch of the first ETFs on KASE indices, which expands investment opportunities, increases diversification and makes the exchange market more accessible for investors.

Special attention was paid to new projects: the KASE Privilege Market Maker program aimed at increasing the liquidity of the stock market (four market makers and 11 stocks are participating in it), as well as launch of the KASE Market Data Hub digital platform providing centralized and transparent access to market data and forming the basis for development of analytics and digital services.

Chairperson of KACC's Management Board Natalia Khoroshevskaya emphasized the key role of clearing in the market stability. KACC reduces the participant risks, ensures settlement reliability and reduces transaction costs through cross-margining and netting. Further confirmation of the center’s strength was the assignment of BBB- rating with stable outlook from Fitch Ratings.